Inheritance Tax Planning Advice

Keep What You’ve Built. Pass It On — Without Unnecessary Tax or Confusion.

If your estate includes property, pensions, investments, business interests or other assets, you could face a hefty inheritance tax (IHT) bill. Worse — your loved ones may end up with a messy estate and uncertainty, when you want to leave clarity, security and legacy.

At Lucent, inheritance tax planning is part of your overall financial strategy. Our holistic and tailored advice protects your wealth — so your legacy stays in the family, not with the tax man.

Clients Trust Lucent for IHT Planning Advice

Our financial planners, with the support of our wider team, work tirelessly to ensure our clients receive the highest standards of advice and care. We are proud of the reviews we receive on third party sites.(Numbers updated Dec 2025)

Why Inheritance Tax Planning Matters More Now Than Ever

- Rising property values, increasing pensions and complex asset structures push more people into the inheritance-tax net.

- Without careful planning, your estate could trigger a 40% IHT charge (after allowances), drastically reducing what you leave behind.

- Time and complexity make DIY planning risky — errors with wills, trusts or tax reliefs can create legal pain, disputes or unintended tax bills.

- Families often don’t even know the full value of their estate — assets are fragmented across pensions, properties, investments, businesses, and more.

The result: your wealth may be eroding silently — or your loved ones could be landed with an unexpected tax-heavy inheritance.

A Clear, Thoughtful IHT Solution That Protects Your Legacy

At Lucent, we take a holistic approach to IHT planning, which is built into your overall financial plan.

We build a joined-up plan that considers:

- Your properties, savings, investments, pensions and business assets

- Tax liabilities — now and on death

- Trusts, lifetime gifts, and reliefs (for business or agricultural assets, when applicable)

- Protection for dependants, children (even from previous relationships), and other beneficiaries

- Estate liquidity — ensuring there’s cash or insurance to cover any IHT bill

With all the pieces connected, you know exactly what will happen, how to protect more for your heirs, and how to minimise tax legally and ethically.

.webp)

What a Well-Structured Inheritance Tax Plan Gives You

- Confidence that your children, spouse or beneficiaries will receive what you intend — not a tax-reduced version

- Peace of mind that your estate is structured, debts & liabilities accounted for, and legal/administration risk minimised

- Tax-efficient wealth transfer using legal reliefs, gifting, trusts or insurance — not tricks or gimmicks

- Clear documentation (wills, trusts, letters of wishes) that avoids family disputes and confusion

- The flexibility to adapt your plan as life changes — without painful re-writes or unintended tax consequences

Our Straightforward, Five-Step Approach to IHT Planning

1. Discover

We begin by understanding everything that matters: your assets, family situation, dependants, business interests, future wishes.

2. Evaluate & Model

We collate all data — properties, pensions, investments, business value — and model your estate’s likely value and IHT liability.

3. Plan & Structure

We design a legally robust plan: wills, trusts, gifting strategies, tax-efficient estate transfer structures — tailored for you.

4. Document & Implement

We work with professional wills/estate-planning partners (legal or trust specialists where required) to put the plan in place — carefully and correctly.

5. Review & Adjust

As your circumstances evolve — new property, growing children, business changes — we revisit and adjust the plan.

Who Benefits Most from Inheritance Tax Panning

Wherever you sit, our IHT planning adapts to your life — not the other way around.

Individuals & Families

Owning property, savings or pensions; wanting to ensure children or spouse are provided for.

Business Owners & Entrepreneurs

Needing to structure business exits, shares or assets for inheritance tax relief and smooth succession.

Anyone With Complex Assets

Multiple properties, overseas assets, pensions, investments or blended family responsibilities.

Those Wanting Peace of Mind

Wanting clarity, structure, and a pain-free legacy for their heirs.

Why People Choose Lucent for IHT Planning

- Independent, Chartered Advice — no product-pushing. Just clear, regulated guidance.

- Holistic view, not piecemeal fixes — estate planning integrated with retirement, tax and wealth planning.

- Tax-savvy, legally compliant strategies — gifting, trusts, reliefs, insurance — used properly, ethically and lawfully.

- Clear documentation & trustee support — wills, trusts, letters of wishes so your estate is easy to administer.

- Long-term partnership — review and update as life changes, not a one-off transaction.

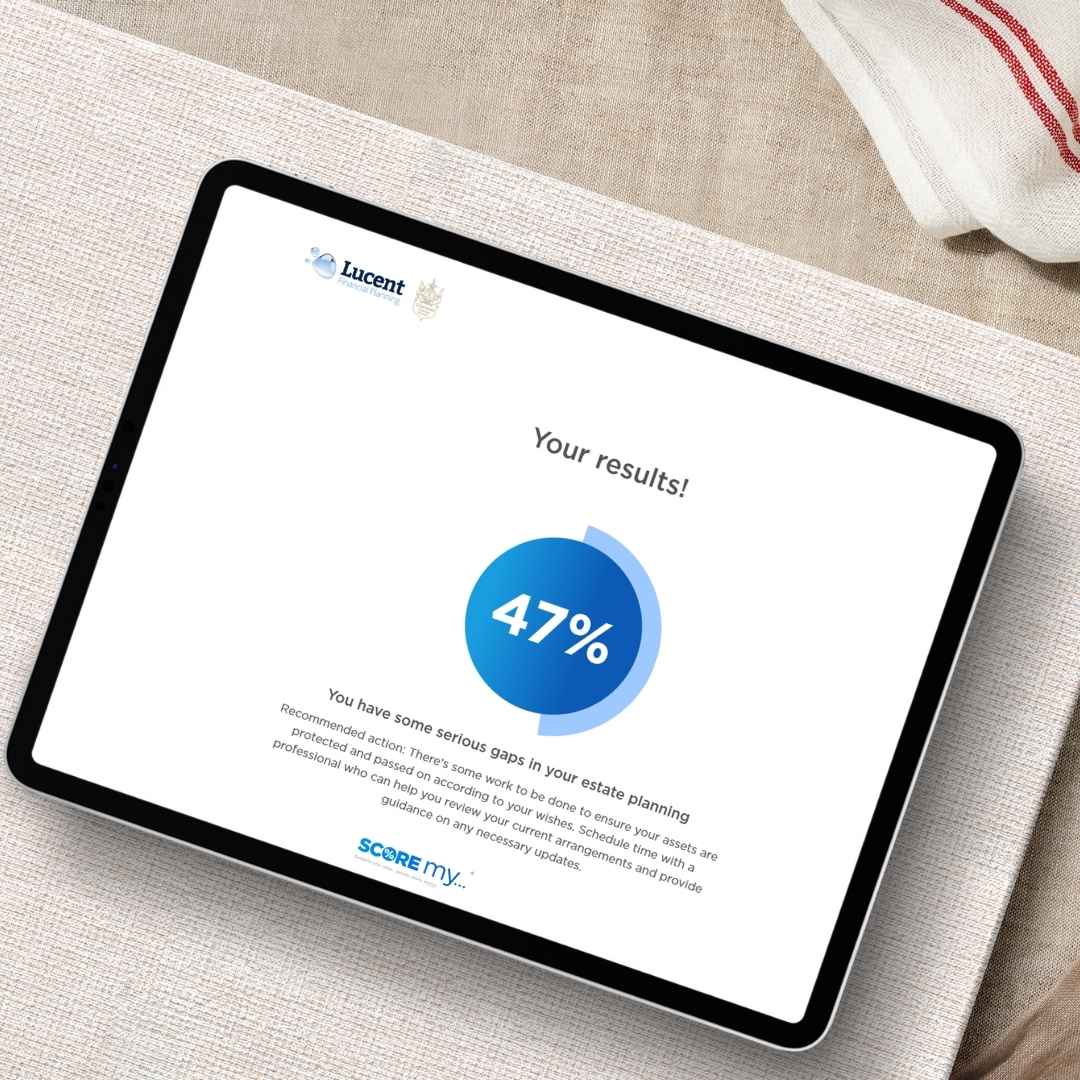

Will Your Estate Be Distributed as You Wish?

It’s one of life’s most important questions — and one too many people avoid.

In just two minutes, this quick and confidential assessment reveals how secure and confident you feel about your legacy plans, and whether your wishes are clearly protected. Once complete, we can use your responses to personalise advice around your goals and needs.

Take a moment now to protect those you care about.

- Free

- Takes 2 minutes

- Get your score instantly

- Secure and confidential

Ready to protect your legacy?

Contact us today to ensure your legacy is protected and passed on with minimal tax liabilities.

- Do you want to protect wealth for your children, grandchildren or beneficiaries?

- Is your family is blended or complex — spouse, children from different relationships — and you want clarity around inheritance?

- Are you looking for professional advice on legacy planning and the best way to leave an inheritance?

- Would you like guidance on using trusts or other strategies to protect your estate?

If you answer yes to the above, get in touch.

FAQs

IHT planning involves organising your financial affairs to manage and distribute your assets both during your lifetime and after your death. In the UK, effective estate planning is essential to ensure your wishes are honoured, your loved ones are cared for, and your tax liabilities are minimised.

An estate plan becomes necessary as soon as you acquire significant assets or have dependents who rely on you financially.

When it comes to estate planning, a financial planner evaluates tax implications and seeks to minimise the financial burden on your heirs. Their holistic approach to managing your wealth and responsibilities ensures peace of mind for you and security for your beneficiaries.

Inheritance tax is charged at 40% on the value of your estate over the IHT threshold, currently set at £325,000 per person plus you might be entitled to an additional allowance if you are leaving your house to direct descendants. We can help reduce this through allowances, gifts, and trusts.

We design a tax-efficient estate plan tailored to your personal and business assets, ensuring your estate is structured to minimise tax liabilities for your heirs.

Trusts allow you to control how your assets are distributed, reduce inheritance tax liability, and provide protection for vulnerable beneficiaries or children.

If you don't give us all the information, you’ll get a plan with holes in it. We need that information understand the extent of the problem, when we know that, we can plan effectively.

The documents you need will vary depending on your personal situation and whether you run a business.

If you're married and leaving your home to your children, then estates in excess of £1 million could do with additional planning. If single, then anything over £325,000 could suffer inheritance tax.

Approximate guesses are fine. Numbers change daily anyway, so a rough idea is fine.

They may have differing opinions to yours and so it is vital you are both aware of them and joined up on this matter.

It depends on what has been put in place! The time we have left is reducing every day, so chop chop!

Once a year as a minimum, but we are open to you whenever you need us.

Still have questions?

If you've got a question we haven't answered, we'd love to hear from you.

.jpg)

.jpg)