Financial Planning Blogs

Explore our collection of expert blogs covering all aspects of financial planning. From investment strategies to retirement planning and wealth management, our insights help you make informed decisions and take control of your financial future. Read, learn, and plan with confidence.

Find the Insights You Need

Looking for a specific topic? Browse our blogs by category to find expert insights on investing, retirement, tax planning, and more. Click on a category to explore articles tailored to your financial interests and goals. Start reading now!

Note: Some blogs may contain links to external websites and Lucent Financial Planning Ltd cannot be held responsible for the content of those websites.

.jpg)

Protecting Your Legacy

.jpg)

What Triggers People to Seek Financial Protection?

How to Protect the Financial Future of Your Family

.jpg)

Why So Many People Delay Financial Protection - Until It’s Too Late

The Emotional Toll of Financial Uncertainty - And Why It’s So Hard to Talk About

Altruism - Alternative Truths

Signs You Might Need a Financial Planner

The Risks of Managing Your Own Financial Planning

Why So Many Financial Resolutions Fail by February

Financially Smart Ways to Start 2026

Jingle bells!

The Festive Financial Fog: Why Christmas Might Be the Wake-Up Call You Need

Christmas First, Planning Later? Why That Might Be a Mistake…

Is Festive Spending Derailing Your Financial Future?

How Cashflow Modelling Brings Clarity and Control to Your Financial Future

The Numbers Don’t Work

500x375.jpg)

How to Transition Smoothly Into Retirement (and Actually Enjoy It)

How to Manage Pension Contribution Deadlines

Procrastination in Retirement Planning: The Hidden Cost

Overcoming Retirement Fears: Building Financial Security That Lasts

Money & Mischief - Chchchchch….Changes

Savings vs. Security: Why Your Cash Reserves Aren't Your Best Defence

Beyond the Check-Up: Why Health Awareness Months are a Financial Wake-Up Call

Beyond the Hospital Bill: The Hidden Cost of Unexpected Illness

Beyond the Policy: The Unseen Value of Financial Protection for High-Net-Worth Individuals

The Hardest Money Conversations Usually Aren’t About the Money

As the Seasons Turn: Why Autumn Sparks a Need to Prepare

The High Cost of Leaving Inheritance Tax to Your Family

How to Deal with Probate and Why It’s Becoming So Complex

18 Things to Consider When Preparing Your Financial Affairs Before Death

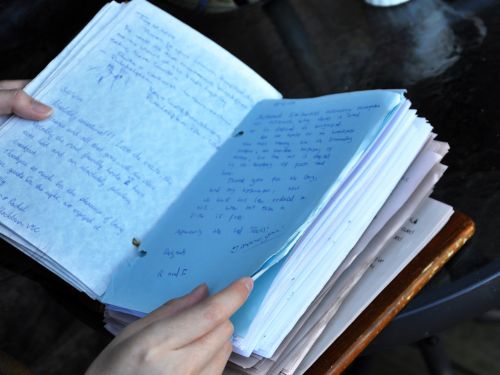

Choose Your Happiness From the Visitor’s Book Menu

When’s the Right Time to Rebalance My Portfolio?

Top 10 Things to Do During Your Mid-Year Investment Review

Can I Leave My Investments Alone to Look After Themselves?

How to Ensure Investment Portfolios Remain Aligned with Goals

Money & Mischief - Inheritance Tax

How to Manage Intergenerational Wealth Transfer Conversations

How Do I Leave a Meaningful Legacy Without a Tax Burden?

Inheritance Tax Doesn’t Affect People Like Me

Concerns Over Insufficient Pension Pots and Retirement Income Shortfalls

Securing a Comfortable Retirement Lifestyle

What Should I Do When I Get My Annual Pension Statement Update?

Is a Workplace Pension Enough to Retire On?

It’s only a game, so put up a real good fight

Your Proposal To Make A Big Mistake

Climate Change’s Effect on Investments

A New Dawn and the Wise Words of a Tortoise

How Do I Find a Lost Pension?

Tips on How To Discuss Estate Planning With Your Parents

What Trumps Happiness?

15 Reasons Why Retirement Planning Is Important

What Is Financial Protection?

When Should I Stop Saving for Retirement?

Is a Financial Planner the Same as an IFA?

Understanding the 2024 UK Budget

How Much Does a Financial Adviser Cost?

What Estate Planning Documents Do I Need?

What Is a Pension and How Does It Work?

Behavioural Finance: What’s All the Fuss About?

What Is Cashflow Modelling?

%20Mean_500x535_Lucent.jpg)

What Does Assets Under Management (AUM) Mean?

Steve's Financial News Update August 2024

What Is Financial Planning?

What Could Labour's Upcoming Budget Mean for Your Financial Plan?

When Should You Start Saving for Retirement?

What Is a Financial Planner and What Do They Do?

When Is the Best Time to Start Estate Planning?

What Can Financial Planning Help You Do?

Paying the Price of Being Human

What Is Retirement Planning?

What Is Estate Planning and Why Is It Important?

General Elections Lead to General Introspections

May Day, May Day

April Fools Day, or a Life for Fools

We Fear Change

Why Do We Grow?

Steve's Review of 2023

Life's Revolutions

How Shares Stack Up Against Cash

The Enduring Wealth-Creating Power of Work and the Stock Market

Lifestyle Financial Planner of the Year 2023